On January 11, 2025, the “2025 International Wealth Management and Financial Investment Forum · Hong Kong,” hosted by ‘Moneyweekly’ Media, was grandly held at the Sheraton Hong Kong Hotel & Towers in Tsim Sha Tsui, Hong Kong, China. Under the theme “Wisdom Converges in Hong Kong, Wealth Connects the World,” the forum brought together domestic and international experts in financial investment and wealth management, professionals from insurance, securities, funds, and foreign exchange sectors, as well as representatives from family offices, high-net-worth individuals, professional media, and research institutions to explore emerging trends in financial investment and wealth management.

The forum featured prominent speakers, including renowned economist Tao Dong, who delivered a keynote on “Global Economy and Markets: A Reset.” He analyzed global economic shifts, noting the end of the U.S. Supercycle, changes in global trade patterns, Japan’s economic recovery, Europe’s structural challenges, and Germany’s slowdown.

Tao emphasized China’s proactive policy approach, including expansionary fiscal measures, accommodative monetary policy, and efforts to boost domestic demand, consumption, investment efficiency, and stabilize the property market.

He highlighted China’s strong economic resilience and long-term growth potential, stressing that competition in AI reflects national strength, where China holds a global manufacturing and industrial advantage.

Hong Kong is one of Asia’s leading international financial centers and has long been ranked among the world’s top three financial hubs alongside New York and London. As the global economy evolves, Hong Kong is actively exploring new areas of growth. At the forum, Gu Jiali, former Deputy Secretary for Financial Services and the Treasury of the HKSAR Government, Co-Chair of the Board of the Belt and Road Cultural Exchange Women’s Foundation, and Co-Chair of the Asia-America-Europe Enterprise Cooperation and Development Forum, stated in her address that Hong Kong is opening new horizons for financial services.Last year, Hong Kong announced its vision to develop into an international gold trading center. Leveraging its unique geographical location, strong logistics network and infrastructure, as well as world-class professional services, Hong Kong aims to build a comprehensive ecosystem covering both physical and financial gold trading. This includes the provision of related financial products such as funds, forward contracts, swaps, and futures. To enhance Hong Kong’s commodity storage and delivery capabilities—particularly for non-ferrous metals—and to better serve mainland enterprises participating in international commodity trade, Hong Kong will also facilitate international commodity exchanges in establishing accredited warehouses in the city, while strengthening related financial services to support a robust commodity trading ecosystem.

Gu further noted that Hong Kong will continue to expand market connectivity to reinforce its position as an international financial center. On the one hand, Hong Kong is working to consolidate and deepen its links with the mainland. Through the various Connect schemes, international investors can access mainland markets and vice versa. These mechanisms have continued to expand from equities and bonds to exchange-traded funds (ETFs), derivatives, and most recently, real estate investment trusts (REITs). Ongoing connectivity between Hong Kong and the mainland has further enhanced Hong Kong’s uniqueness and appeal on the global stage.

As one of the world’s major centers for financial innovation, Hong Kong offers extensive opportunities across investment, asset management, and wealth management. Gu emphasized that Hong Kong’s focus extends beyond connectivity with the mainland to broader global linkages, particularly with emerging markets. Shifts in global economic dynamics have revealed significant business opportunities in these markets. In addition to strengthening financial ties and encouraging two-way capital flows with regions such as the Gulf and ASEAN, examples include an ETF investing in the Saudi market being listed in Hong Kong, and two Hong Kong-focused ETFs being listed on the Saudi Exchange. Hong Kong has reached strategic cooperation agreements with these partners to bring their businesses to the region and capture opportunities across the Greater Bay Area, the mainland, and ASEAN markets.

At the forum, Chen Yue, Chairman of ‘Money Weekly’, stated in his address that amid the overlapping trends of deglobalization and a new phase of globalization, four key areas deserve close attention. First, capital will follow new globalization trends—particularly technological globalization and the global expansion of Chinese enterprises—creating significant investment opportunities. Second, relationships among major currencies will undergo substantial changes, leading to increased exchange rate volatility. Third, asset classes will become more diversified and internationalized, driving growing demand for global asset allocation. Fourth, digital currencies are gaining wider recognition, with major digital assets gradually strengthening their roles as reserve assets, payment instruments, and components of asset allocation.

Chen noted that these developments place higher demands on the international wealth management and financial investment industry. In response to greater asset diversification, wealth management and investment products and tools will become more varied; in line with digital transformation, channels and delivery methods will become more efficient and convenient; and amid increasingly complex markets, risk assessment and management frameworks will need to be more mature and robust. He emphasized that ongoing transformation, innovation, and development across the global wealth management and financial investment sector will give rise to a new ecosystem, providing more diversified and client-focused services for investors and high-net-worth individuals. Against this backdrop, Hong Kong as an international financial center faces new opportunities and challenges, which is why the forum was held in Hong Kong at this time.

During the forum, a number of distinguished speakers delivered keynote presentations. Gu Yijun, Global Vice CEO of Wealth Management at Noah Holdings, spoke on “Embracing the New Cycle and Adjusting Wealth Allocation.” Huang Zexin, Guest Economist at AXA, shared insights on “Asset Protection and Succession for Chinese Private Entrepreneurs.” Fadi Reyad, Chief Marketing Strategy Officer at Moneta Markets, presented on “Behavioral Patterns of Successful Traders,” while Lin Mingtiam, Asia-Pacific Chief Analyst at ATFX, discussed “Fintech-Driven Diversified Investment Opportunities.”

Meanwhile, the Hong Kong forum featured three roundtable discussions. Participants included Li Jun, President of Shanghai Liyu Financial Group and market commentator on foreign exchange and gold for Shanghai First Financial; Xu Yaxin, Dean of Jiangxin Academy; Shao Yuehua, author of the Trading Code series; Cui Rong, Dean of Weitui Financial Institute and special guest of Shanghai First Financial; Li Sheng, nationally certified analyst, member of the International Federation of Technical Analysts (IFTA), and author of Gold Trading Masters; Zhang Juxian, Dean of Juxian Trading Academy; and Sun Jianfa, renowned investment analyst and columnist for financial media. The discussions focused on “The Impact of Major Global Economic Shifts in 2025 on Monetary Policy and Strategic Responses.”

Zhang Weijun, Co-founder of Mantianxing Professional Traders Alliance; Xie Deqi, Dean of Jianyi Business School and Gold Analyst at Blue Whale Securities; Li Lieting, Asia-Pacific Market Director at PGMarkets; Chen Haixiang, Founder of FXVC and FXFOF; Li Luoxi, Founder of Moses Financial Trading Academy; Chen Jun, Founder and Chief Strategist of Julang Capital; and Li Xiaodong, Chief Editor of Traders Talk, engaged in an in-depth discussion on “Outlook and Key Trends in the Investment and Wealth Management Market for 2025.”

Qiu Jian, Founder of Forexpress Media (FOREXPRESS) and the Traders Talk brand; Lu Qiyong, General Manager of Guanrong Technology; Zhong Zhixin, Founder of Maihui Data Statistics Indicators; Pan Xuesen, Head of Simai Asset Management; Qi Xuejun, Founder of Qitian Quantitative Trading Academy; and Yang Tao, Technical Director of Xinguo Trading, shared insights and analysis on the theme of “Technology Empowerment in Asset Management and the Future Development Roadmap.”

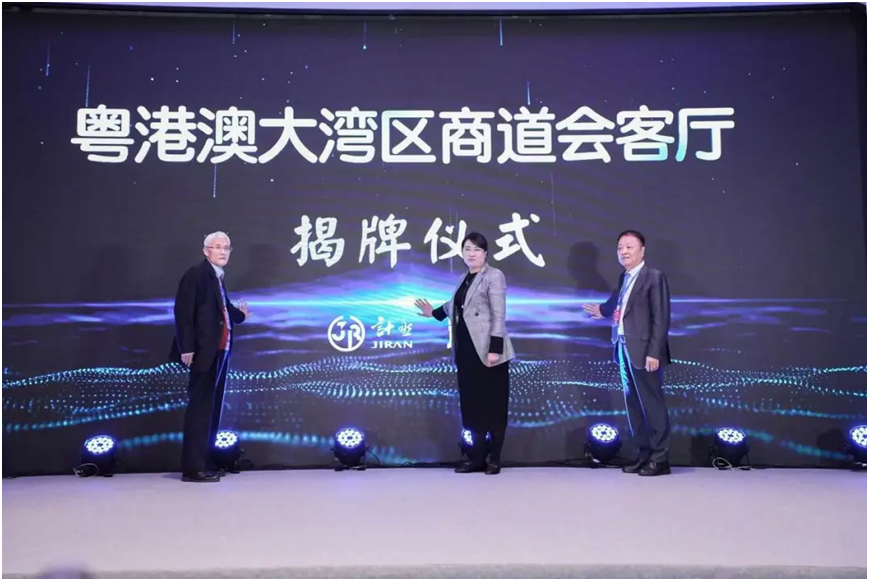

During the 2025 International Wealth Management and Financial Investment Forum – Shanghai Wealth Expo Hong Kong Forum, the unveiling ceremony of the “Guangdong–Hong Kong–Macao Greater Bay Area Business Salon” was also held. The launch of this initiative is expected to strongly promote the high-quality development of the wealth management industry.In addition, the forum released the Analysts in Focus (2025) report, providing an important reference for the healthy and sustainable development of the wealth management and financial investment sector.

The forum was hosted by ‘Money Weekly’, co-organized by Zhifu Wealth Management, with special support from AXA, and Noah Holdings as a strategic partner. Supporting organizations included the Organizing Committee of the Shanghai Wealth Expo, the Hong Kong Institute of Certified Financial Advisers, the Lujiazui Family Office Alliance, the Mantianxing Professional Traders Alliance, the China Analysts Alliance, and the Digital Technology Association.The event also received professional support from institutions including Traders Talk, Jialing Network Public Relations, Gold Exchange Headlines, FXVC Jianxin Academy, Y2 Forum, Followme, OKCOPY Smart Copy Trading, Super Traders Forum, Huiyou Post Station, Huishang Langya Rankings, and the Traders Alliance, as well as strategic media support from StockStar.